In my opinion, yes. When I tell people there are opportunities to lock in for 10 years at 3.99% to avoid sticker shock at renewal time, or suggest that they could get a free down payment mortgage for 5.24%, or get 3% of their purchase price back with a cash-back mortgage at 4.09% to tame their debts, I am frequently hearing “That’s a lot! I want a 5 year at 3%”.

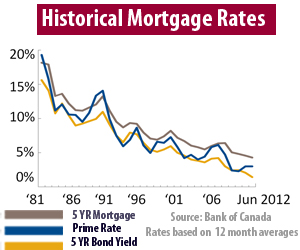

Let’s look at some history:

1. When I was selling real estate back in the 90’s, I had to buy a new amortization schedule book when rates went down below 7%. People were ecstatic!

2. Since 1981, the average 5 year mortgage rate is 9.02%. The average Prime rate is 7.75% and the average 5- year bond yield rate is 6.87%.

Take a look at the following graph and tell me when, if ever, rates will be this low again in our lifetimes…

Add in the new bonus incentive from the government of British Columbia for 5% cash in your pocket (up to $10,000 of the purchase price on newly constructed home) and it is like free money. Some conditions apply, but it is worth the time to learn more. Although you can’t use this directly as a down payment, if you receive a non-repayable gift from a direct family member for your down payment, there’s no reason you can’t re-gift it back after your sale completes!

If you have a mortgage now and are in your home for the long term, locking in for 10 years could save you thousands and after the end of the 5th year, penalties to get out of it are minimal.

If you have the means to handle a mortgage, but are short on a down payment or closing cost, or have some debts to pay off, a cashback product might be your answer at today’s rates. I wouldn’t be saying that if rates were higher.

Keeping in mind that both the borrower and property must qualify for these mortgages, this is still a phenomenal time in history. What might be lacking is consumer in confidence. When is the right time for you?

Caroline Lennox

Caroline Lennox

Mortgage Broker and iLease Financing Professional

Invis – Canada’s Mortgage Experts™

Visit Caroline’s website

See all articles by Caroline Lennox